Innovations in the banking sector have transformed the way people manage their finances. One Finance Bank, a pioneering institution, has taken the lead in revolutionizing banking solutions. With its commitment to technological advancements, customer-centric approach, and a wide range of services, One Finance Bank has become a game-changer in the industry. This article explores the various ways in which One Finance Bank has transformed banking services to meet the evolving needs of its customers.

Table of Contents

- Cutting-Edge Technological Infrastructure

- User-Friendly Mobile Banking App

- Personalized Customer Service

- Enhanced Security Measures

- Diverse Product Portfolio

- Collaborations and Partnerships

- Financial Education Initiatives by One Finance Bank

- Streamlined Loan Approval Process at One Finance Bank

- One Finance Bank’s Commitment to Corporate Social Responsibility

- One Finance-Bank’s Focus on Financial Inclusion

- Conclusion

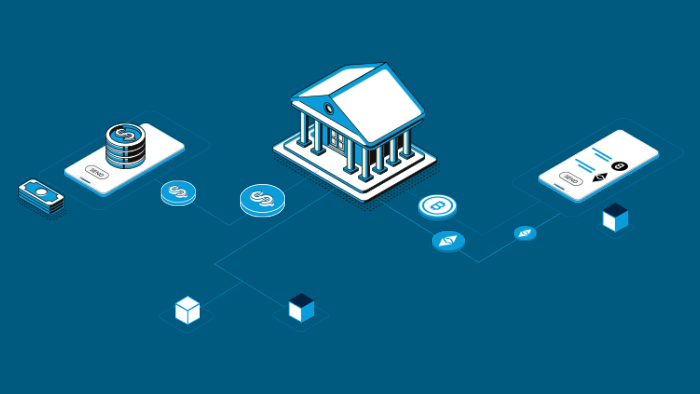

Cutting-Edge Technological Infrastructure

One Finance Bank’s success lies in its robust technological infrastructure. The bank has heavily invested in state-of-the-art systems, ensuring seamless operations and enhanced security. By utilizing advanced algorithms and data analytics, One Finance Bank offers personalized banking experiences tailored to individual customers. This technology-driven approach enables quick and efficient transactions, eliminating the need for customers to visit physical branches.

User-Friendly Mobile Banking App

One Finance Bank understands the importance of convenience in today’s fast-paced world. Hence, they developed a user-friendly mobile banking app that empowers customers to manage their finances anytime, anywhere. The app provides a secure platform for account access, fund transfers, bill payments, and much more. Its intuitive interface and comprehensive features make banking effortless for customers, promoting financial independence and control.

Personalized Customer Service

Unlike traditional banks, One Finance Bank puts customers at the forefront of its operations. The bank emphasizes personalized customer service, recognizing that each individual has unique financial goals and requirements. Dedicated relationship managers offer expert guidance and assistance, ensuring that customers receive tailored solutions that align with their needs. This personalized approach fosters long-term relationships and customer loyalty.

Enhanced Security Measures

Security is a top priority for One Finance Bank. The institution employs advanced security measures to safeguard customer information and transactions. Robust encryption protocols, multi-factor authentication, and real-time monitoring systems ensure the integrity of customer data. By prioritizing security, One Finance Bank instills confidence in customers, making them feel safe and protected while conducting their financial transactions.

Diverse Product Portfolio

One Finance Bank offers a diverse range of products and services to cater to the varying needs of its customers. From basic savings and checking accounts to investment options and loans, the bank provides comprehensive financial solutions. This diverse product portfolio enables customers to access a wide array of services conveniently under one roof, simplifying their financial management.

Collaborations and Partnerships

One Finance Bank understands the power of collaboration. The institution actively seeks partnerships with fintech companies and other industry leaders to enhance its offerings. By leveraging the expertise and innovative solutions of its partners, One Finance Bank stays at the forefront of banking advancements. Collaborations allow the bank to introduce cutting-edge services and provide customers with the latest financial tools.

Embracing Sustainable Practices (Word count: 150) In an era of increasing environmental consciousness, One-Finance Bank has embraced sustainable practices. The bank is committed to reducing its carbon footprint by adopting eco-friendly technologies and minimizing paper-based transactions. Additionally, One Finance-Bank promotes sustainable investments and educates customers about responsible financial practices, fostering a greener future for the banking industry.

Financial Education Initiatives by One Finance Bank

One Finance Bank goes beyond traditional banking services by offering comprehensive financial education initiatives. Recognizing the importance of financial literacy, the bank conducts workshops, webinars, and online resources to empower customers with essential knowledge about managing their finances. Through these initiatives, One-Finance Bank equips individuals with the necessary skills to make informed financial decisions and achieve their long-term goals.

Streamlined Loan Approval Process at One Finance Bank

Securing loans can often be a time-consuming and complex process. However, One-Finance Bank simplifies the loan approval process, ensuring a seamless experience for customers. Leveraging their advanced technology infrastructure, the bank offers a streamlined and efficient loan application process. From initial application submission to final approval, customers can benefit from quick turnaround times, reducing the hassle associated with obtaining loans.

One Finance Bank’s Commitment to Corporate Social Responsibility

One Finance Bank understands the importance of giving back to society. The institution actively engages in corporate social responsibility (CSR) initiatives to make a positive impact on communities. Through partnerships with charitable organizations and community development programs, One-Finance Bank supports causes such as education, healthcare, and environmental conservation. By incorporating CSR into their business model, the bank demonstrates its commitment to social welfare.

One Finance-Bank’s Focus on Financial Inclusion

One Finance Bank strives to promote financial inclusion by reaching out to underserved communities and individuals. The bank offers accessible banking solutions to those who may have limited access to traditional financial services. Through innovative initiatives like mobile banking vans and community outreach programs, One-Finance Bank ensures that everyone has equal opportunities to manage their finances effectively, regardless of their location or background.

Conclusion

One Finance Bank has set a new benchmark in the banking industry by revolutionizing banking solutions. Through its cutting-edge technology, user-friendly mobile app, personalized customer service, enhanced security measures, diverse product portfolio, collaborations, and sustainable practices, the bank has redefined the way people manage their finances. By consistently evolving and adapting to the changing needs of customers, One Finance-Bank continues to be a leader in the industry, providing innovative and customer-centric banking solutions.

Learn about: Unlock your career potential with fully remote accounting jobs in the finance sector, offering flexibility, growth, and work-life balance.